Introduction:

In the realm of mortgage contracts, the question of whether banks can switch currency often arises, posing concerns and considerations for borrowers. This article aims to provide clarity on this matter, exploring the risks, implications, and considerations associated with currency denomination changes. Let’s delve into the complexities of currency switching in mortgage contracts and offer guidance to borrowers like Cathy.

Currency Switching in Mortgage Contracts

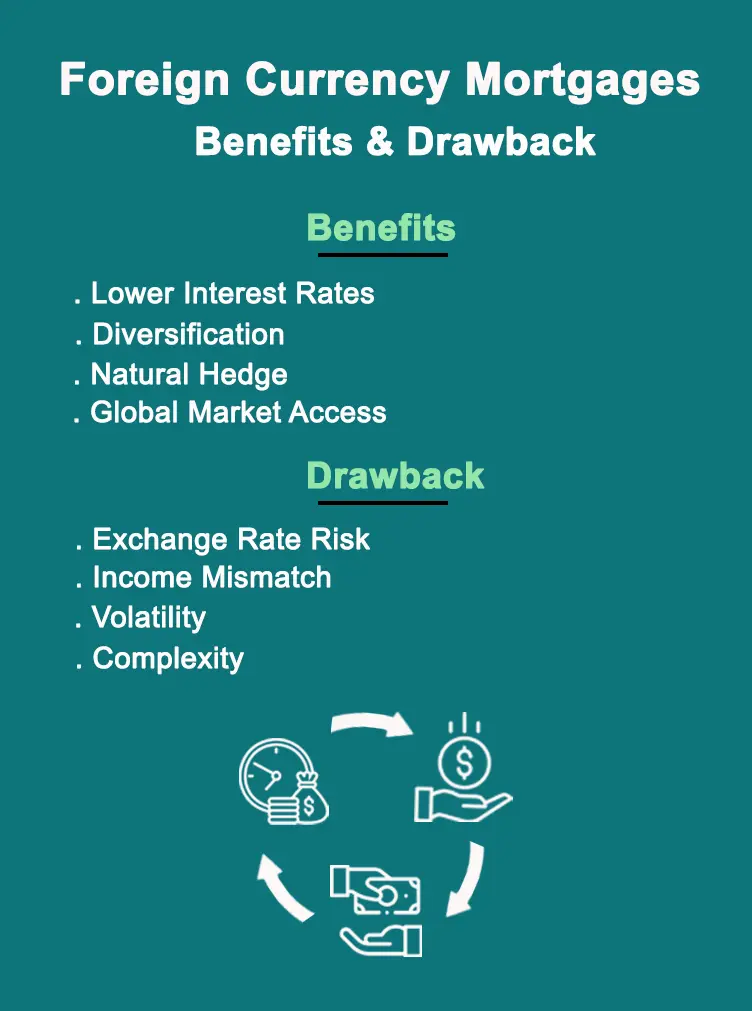

Currency switching in mortgage contracts refers to the practice where financial institutions alter the designated currency of a mortgage agreement. This adjustment can occur for various reasons, such as changes in economic conditions, currency stability, or borrower preferences. Essentially, it involves transitioning from one currency denomination to another, potentially impacting the terms, repayment obligations, and overall cost structure of the mortgage for the borrower.

When currency switching occurs, borrowers may find themselves repaying their mortgage in a different currency than initially agreed upon. This change introduces complexities and uncertainties, as fluctuations in exchange rates can significantly affect the cost of repayments. Understanding the implications of currency switching is crucial for borrowers, as it can influence their financial stability, affordability, and long-term planning.

Evolution of Currency Denomination Practices

- Early Mortgage Practices: Initially, mortgage contracts were predominantly denominated in local currencies, reflecting the stability and familiarity of domestic monetary systems. This practice prevailed for centuries, providing borrowers with a sense of security and predictability in repayment obligations.

- Globalization and Financial Innovation: With the advent of globalization and advancements in financial markets, banks began offering mortgages denominated in foreign currencies. This shift was driven by increased access to international capital markets and the desire to diversify lending portfolios.

- Currency Flexibility: The evolution of currency denomination practices allowed borrowers to choose from a wider range of currencies for their mortgage contracts, offering potential benefits such as lower interest rates or currency stability.

- Financial Crisis Impacts: The global financial crisis of 2008 prompted a reassessment of currency denomination practices, as exchange rate volatility and currency fluctuations highlighted the risks associated with foreign currency mortgages.

- Regulatory Responses: In response to the financial crisis and its implications for mortgage markets, regulatory authorities implemented measures to enhance transparency and consumer protection regarding currency denomination in mortgage contracts.

Common Reasons for Currency Switching by Banks

Banks may opt to switch currency on mortgage contracts for several reasons, including mitigating currency risk exposure, capitalizing on favorable exchange rates, and catering to customer preferences. One common reason is to align the currency denomination of the mortgage with the borrower’s income currency, reducing the risk of currency mismatch and potential repayment difficulties. Additionally, banks may switch currency to take advantage of lower interest rates available in certain currencies or to diversify their lending portfolios.

Impact of Currency Fluctuations on Mortgage Repayments:

- Currency fluctuations result in higher repayment costs in the borrower’s local currency.

- Rapid currency depreciation makes mortgage payments more expensive, leading to affordability challenges.

- Currency volatility introduces uncertainty in borrowers’ budgeting processes.

- Significant currency depreciation increases default risks for borrowers.

- Currency fluctuations influence interest rates, impacting the overall cost of borrowing.

Understanding the Risks for Borrowers

Currency mismatch occurs when the currency denomination of a mortgage loan differs from the borrower’s income currency. This misalignment exposes borrowers to risks, such as exchange rate fluctuations, making mortgage repayments unpredictable and potentially unaffordable, leading to financial instability and challenges.

Legal and Regulatory Framework Governing Currency Switching

The legal and regulatory framework governing currency switching in mortgage contracts varies by jurisdiction. Regulations aim to protect borrowers by ensuring transparency, disclosure of risks, and adherence to fair lending practices, while also addressing lenders’ obligations and responsibilities in currency-related transactions.

Factors Influencing Banks’ Decision to Switch Currency

- Exchange rate stability

- Borrower income currency

- Interest rate differentials

- Regulatory compliance requirements

- Market demand and trends

Best Practices for Borrowers When Reviewing Mortgage Contracts

When reviewing mortgage contracts, borrowers should carefully examine currency denomination clauses, seek clarification on terms related to currency switching, consider potential risks associated with exchange rate fluctuations, and consult with financial advisors to make informed decisions.

Case Studies: Real-Life Examples of Currency Switching

In one case study, a borrower experienced financial strain when their mortgage switched to a stronger currency, increasing repayment costs. Another borrower benefited from a currency switch, capitalizing on favorable exchange rates and reducing repayment burdens.

Currency Hedging Strategies for Borrowers

- Forward contracts

- Options trading

- Swaps agreements

- Natural hedging

- Currency ETFs

Assessing the Financial Impact of Currency Switching

Assessing the financial impact of currency switching involves analyzing exchange rate trends, calculating potential repayment fluctuations, evaluating affordability risks, and considering long-term financial implications. It requires thorough assessment and proactive planning to mitigate potential challenges.

Risks of Currency Switching in an International Mortgage Market

Risks of currency switching in an international mortgage market include exchange rate volatility, potential affordability challenges for borrowers, increased default risks, regulatory uncertainties, and the complexity of managing currency exposure across different jurisdictions, which may impact financial stability.

How Borrowers Can Protect Themselves Against Unauthorized Currency Changes?

Borrowers can protect themselves against unauthorized currency changes by carefully reviewing mortgage contracts, ensuring clarity on currency denomination terms, and seeking legal advice if uncertain. Additionally, maintaining open communication with lenders and monitoring account activity can help detect any unauthorized changes promptly. It’s essential to assertively challenge any unauthorized modifications and take appropriate legal action to safeguard one’s financial interests.

Financial Institutions Educating Borrowers Currency Risks

Financial institutions play a crucial role in educating borrowers about currency risks associated with mortgage contracts. They provide valuable information and guidance on understanding exchange rate fluctuations, assessing potential risks, and implementing strategies to mitigate currency-related challenges. By empowering borrowers with knowledge, financial institutions promote informed decision-making and financial stability.

Conclusion:

While banks have the discretion to switch currency on mortgage contracts under certain circumstances, borrowers like Cathy must be vigilant and informed about the implications and risks involved. By understanding the factors influencing currency denomination decisions, assessing personal financial stability, and seeking professional guidance, borrowers can navigate currency switching with confidence and protect their financial well-being.

Read More: Understanding Inflation and Gross Domestic Product

Frequently Asked Questions:

Q1: Can banks switch the currency on my mortgage contract without my consent?

In some cases, banks may have clauses allowing currency switching, but they typically require borrower consent or notification.

Q2: How can I protect myself from unauthorized currency changes by banks?

Review your mortgage contract thoroughly, seek legal advice if needed, and monitor account activity for any unauthorized changes.

Q3: What factors influence banks’ decisions to switch currency on mortgage contracts?

Factors include exchange rate stability, borrower income currency, interest rate differentials, regulatory requirements, and market demand.

Q4: What are the risks associated with currency switching in mortgage contracts?

Risks include exchange rate volatility, affordability challenges, increased default risks, regulatory uncertainties, and managing currency exposure across jurisdictions.

Q5: What are some best practices for borrowers when reviewing mortgage contracts?

Best practices include examining currency denomination clauses, seeking clarification on terms related to currency switching, evaluating potential risks, and consulting financial advisors.

Q6: How can financial institutions help educate borrowers about currency risks?

Financial institutions provide valuable information on understanding exchange rate fluctuations, assessing risks, and implementing mitigation strategies to promote informed decision-making and financial stability.